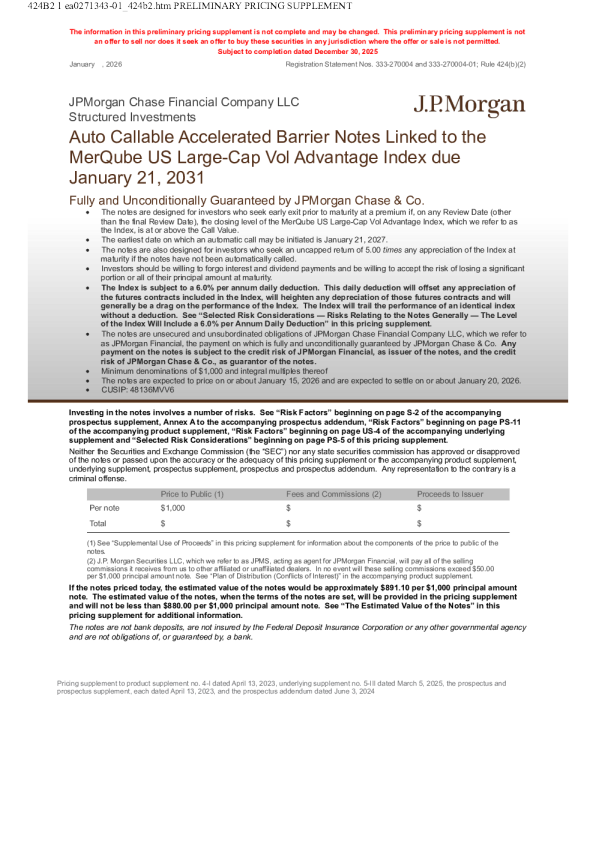

摩根大通美股招股说明书(2025-12-31版)

Auto Callable Accelerated Barrier Notes Linked to theMerQube US Large-Cap Vol Advantage Index dueJanuary 21, 2031 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co.•The notes are designed for investors who seek early exit prior to maturity at a premium if, on any Review Date (other than the final Review Date), the closing level of the MerQube US Large-Cap Vol Advantage Index, which we refer to asthe Index, is at or above the Call Value.•The earliest date on which an automatic call may be initiated is January 21, 2027.•The notes are also designed for investors who seek an uncapped return of 5.00timesany appreciation of the Index atmaturity if the notes have not been automatically called.•Investors should be willing to forgo interest and dividend payments and be willing to accept the risk of losing a significantportion or all of their principal amount at maturity.•The Index is subject to a 6.0% per annum daily deduction. This daily deduction will offset any appreciation ofthe futures contracts included in the Index, will heighten any depreciation of those futures contracts and willgenerally be a drag on the performance of the Index. The Index will trail the performance of an identical indexwithout a deduction. See “Selected Risk Considerations — Risks Relating to the Notes Generally — The Levelof the Index Will Include a 6.0% per Annum Daily Deduction” in this pricing supplement.•The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer toas JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co.Anypayment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the creditrisk of JPMorgan Chase & Co., as guarantor of the notes.•Minimum denominations of $1,000 and integral multiples thereof•The notes are expected to price on or about January 15, 2026 and are expected to settle on or about January 20, 2026.•CUSIP: 48136MVV6 Investing in the notes involves a number of risks. See “Risk Factors” beginning on page S-2 of the accompanyingprospectus supplement, Annex A to the accompanying prospectus addendum, “Risk Factors” beginning on page PS-11of the accompanying product supplement, “Risk Factors” beginning on page US-4 of the accompanying underlyingsupplement and “Selected Risk Considerations” beginning on page PS-5 of this pricing supplement. Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapprovedof the notes or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying product supplement,underlying supplement, prospectus supplement, prospectus and prospectus addendum. Any representation to the contrary is acriminal offense. (1) See “Supplemental Use of Proceeds” in this pricing supplement for information about the components of the price to public of thenotes. (2) J.P. Morgan Securities LLC, which we refer to as JPMS, acting as agent for JPMorgan Financial, will pay all of the sellingcommissions it receives from us to other affiliated or unaffiliated dealers. In no event will these selling commissions exceed $50.00per $1,000 principal amount note. See “Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement. If the notes priced today, the estimated value of the notes would be approximately $891.10 per $1,000 principal amountnote. The estimated value of the notes, when the terms of the notes are set, will be provided in the pricing supplementand will not be less than $880.00 per $1,000 principal amount note. See “The Estimated Value of the Notes” in thispricing supplement for additional information. The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agencyand are not obligations of, or guaranteed by, a bank. Key Terms Automatic Call: Issuer:JPMorgan Chase Financial Company LLC, a direct,wholly owned finance subsidiary of JPMorgan Chase & Co. If the closing level of the Index on any Review Date (other than thefinal Review Date) is greater than or equal to the Call Value, thenotes will be automatically called for a cash payment, for each $1,000principal amount note, equal to (a) $1,000plus(b) the Call PremiumAmount applicable to that Review Date, payable on the applicableCall Settlement Date. No further payments will be made on thenotes. Guarantor:JPMorgan Chase & Co. Index:The MerQube US Large-Cap Vol Advantage Index(Bloomberg ticker: MQUSLVA). The level of the Index reflectsa deduction of 6.0% per annum that accrues daily. Call Premium Amount:The Call Premium Amount withrespect to each Review Date is set forth below: If the notes are automatically called, you will not benefit from theUpside Leverage Factor that applies to the payment at maturity if theFinal Value is greater than the Initial Value. Because the UpsideLeverage Factor does not apply to the payment