道明银行美股招股说明书(2025-12-11版)

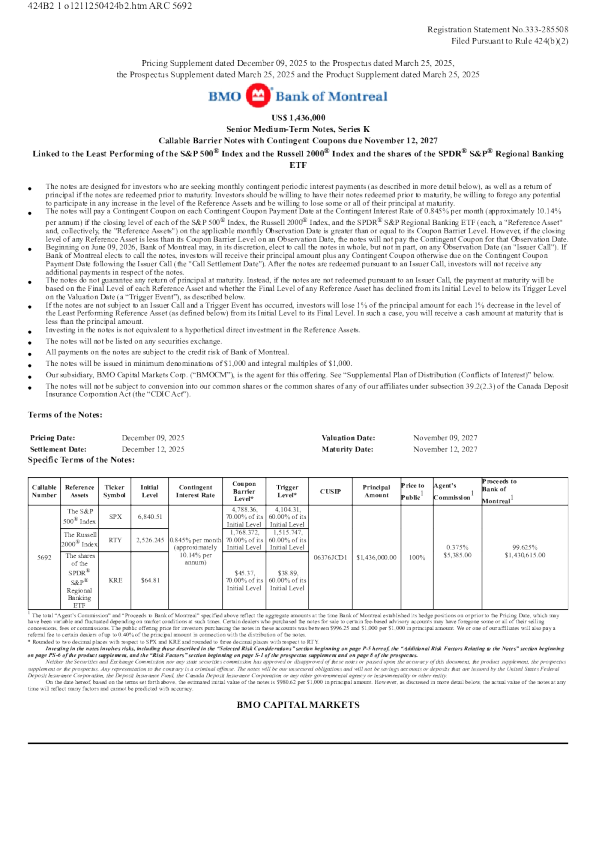

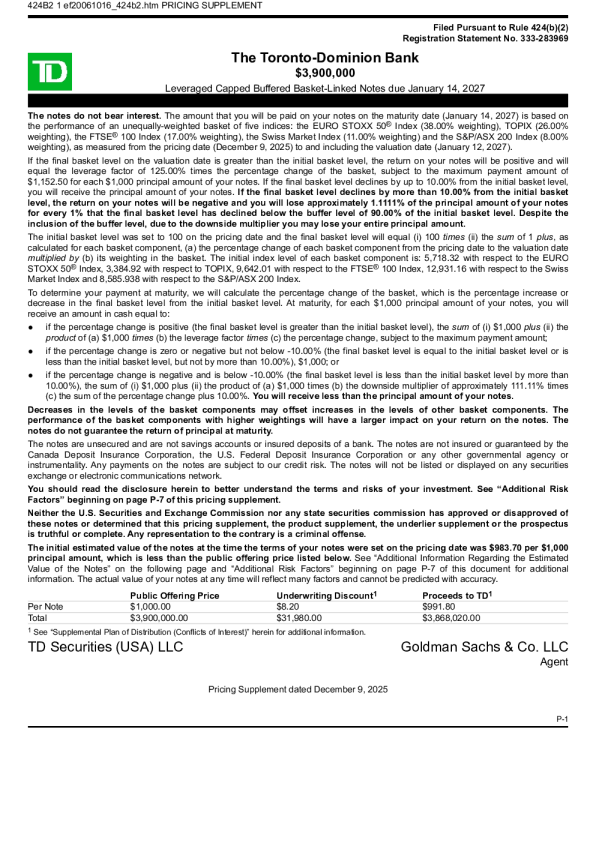

The Toronto-Dominion Bank$3,900,000 Leveraged Capped Buffered Basket-Linked Notes due January 14, 2027 The notes do not bear interest.The amount that you will be paid on your notes on the maturity date (January 14, 2027) is based onthe performance of an unequally-weighted basket of five indices: the EURO STOXX 50®Index (38.00% weighting), TOPIX (26.00%weighting), the FTSE®100 Index (17.00% weighting), the Swiss Market Index (11.00% weighting) and the S&P/ASX 200 Index (8.00%weighting), as measured from the pricing date (December 9, 2025) to and including the valuation date (January 12, 2027). If the final basket level on the valuation date is greater than the initial basket level, the return on your notes will be positive and willequal the leverage factor of 125.00% times the percentage change of the basket, subject to the maximum payment amount of$1,152.50 for each $1,000 principal amount of your notes. If the final basket level declines by up to 10.00% from the initial basket level,you will receive the principal amount of your notes.If the final basket level declines by more than 10.00% from the initial basketlevel, the return on your notes will be negative and you will lose approximately 1.1111% of the principal amount of your notesfor every 1% that the final basket level has declined below the buffer level of 90.00% of the initial basket level. Despite theinclusion of the buffer level, due to the downside multiplier you may lose your entire principal amount. The initial basket level was set to 100 on the pricing date and the final basket level will equal (i) 100times(ii) thesumof 1plus, ascalculated for each basket component, (a) the percentage change of each basket component from the pricing date to the valuation datemultiplied by(b) its weighting in the basket. The initial index level of each basket component is: 5,718.32 with respect to the EUROSTOXX 50®Index, 3,384.92 with respect to TOPIX, 9,642.01 with respect to the FTSE®100 Index, 12,931.16 with respect to the SwissMarket Index and 8,585.938 with respect to the S&P/ASX 200 Index. To determine your payment at maturity, we will calculate the percentage change of the basket, which is the percentage increase ordecrease in the final basket level from the initial basket level. At maturity, for each $1,000 principal amount of your notes, you willreceive an amount in cash equal to: ●if the percentage change is positive (the final basket level is greater than the initial basket level), thesumof (i) $1,000plus(ii) theproductof (a) $1,000times(b) the leverage factortimes(c) the percentage change, subject to the maximum payment amount;●if the percentage change is zero or negative but not below -10.00% (the final basket level is equal to the initial basket level or isless than the initial basket level, but not by more than 10.00%), $1,000; or●if the percentage change is negative and is below -10.00% (the final basket level is less than the initial basket level by more than10.00%), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the downside multiplier of approximately 111.11% times(c) the sum of the percentage change plus 10.00%.You will receive less than the principal amount of your notes. Decreases in the levels of the basket components may offset increases in the levels of other basket components. Theperformance of the basket components with higher weightings will have a larger impact on your return on the notes. Thenotes do not guarantee the return of principal at maturity. The notes are unsecured and are not savings accounts or insured deposits of a bank. The notes are not insured or guaranteed by theCanada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other governmental agency orinstrumentality. Any payments on the notes are subject to our credit risk. The notes will not be listed or displayed on any securitiesexchange or electronic communications network. You should read the disclosure herein to better understand the terms and risks of your investment. See “Additional RiskFactors” beginning on page P-7 of this pricing supplement. Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved ofthese notes or determined that this pricing supplement, the product supplement, the underlier supplement or the prospectusis truthful or complete. Any representation to the contrary is a criminal offense. The initial estimated value of the notes at the time the terms of your notes were set on the pricing date was $983.70 per $1,000principal amount, which is less than the public offering price listed below.See “Additional Information Regarding the EstimatedValue of the Notes” on the following page and “Additional Risk Factors” beginning on page P-7 of this document for additionalinformation. The actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy. TD Securities (USA) LLC Goldman Sachs & Co.